There are a few things in life I do my best to avoid: Coachella-like crowds (L.A. has enough crop-topped hipster youths on uncontrolled substances to last a lifetime), asparagus, port-o-potties and unnecessary vet visits. While I’m able to steer clear of most of these, our annual slog to the vet is a necessary evil. One thing that sets my mind at ease about the entire experience is the pet insurance I’ve acquired. I hope to never need to use it, but it just may save or extend the lives of my furry family members if I do.

Vet visits terrorize my cats and I in distinctly different ways: Angus has perfected the art of playing dead – so much so that one vet asked if he was even alive. After assuring the vet that he was in fact still alive, she examined him and he lurched back to the safe confines of his carrier like a frontline soldier crawling for shelter. While he is the more sickly of the two (perpetually sneezing, tiny runt of my heart), his brother Squeaker is afflicted with more obscure symptoms including fatty deposits (he’s stocky – don’t judge) and the occasional tummy issue (likely caused by his affinity for plastic wrap).

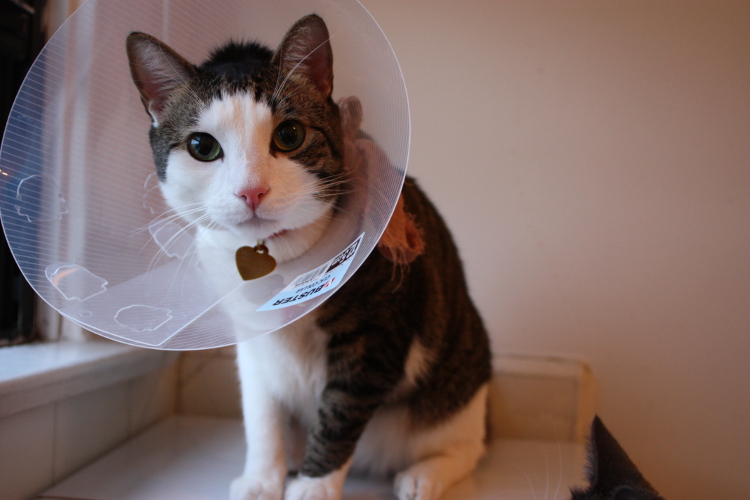

Angus in his box, looking very much alive

Angus in his box, looking very much alive

My portion of terror comes at the end – when I’m handed the bill for the visit in addition to whatever medical necessity they’ve been prescribed; Clavamox, a liquid antibiotic administered in a fight to the death – leaving me with deep scratches and remnants of the sticky white medicine all over my living room floor; a restricted diet to check for allergies (Angus went rogue and stopped eating altogether after two weeks of just lamb); the inevitable ‘cone of shame’ visit, where your feline is forced to don said scarlet cone, lose all equilibrium and bash into everything in sight. A humbling rite of passage for any creature.

So how does one weather the dreaded vet bill, which can easily soar into the thousands?

Many friends of mine have terrible or no healthcare for themselves, yet never flinch at spending thousands on their beloved furry ones – depleting their savings accounts and going into debt to extend their lives. According to peteducation.com the average cost of adopting a cat in its first year ranges from $491 to $3125, with an overall cost of a cat’s life span (14 years) ranging from $4521 to $18,322. This conservative estimate doesn’t take into account any medical issues requiring additional or emergency vet visits (like that time Squeaker went all crazy town, knocked over my wine and darted through shattered glass – a ruined evening for us all).

For me the answer was pet insurance, a luxury expense that, while nice to have, likely won’t pay out over the span of my animals’ lives. But it might come to the rescue if, god forbid, I ever face catastrophic vet bills.

I went in with a clear understanding that this could likely be throwing money down the drain. Most financial professionals feel that the cost of pet insurance outweighs the benefit, advising instead to sock away money into a pet emergency fund. I chose to look at it like my own health or car insurance; hopefully it won’t be needed, but it’s there just in case. I asked for a list of exclusions based on my cats’ medical history & breed. Make sure that the insurance you choose covers hereditary conditions – something considered essential by most vets. Many insurances will deny claims due to hereditary or congenital conditions (considered pre-existing). These exclusions can create loopholes allowing your pet insurance to deny claims.

While our annual vet visit isn’t any less traumatic, I’m relieved that my pet policies haven’t HAD to pay out, which means (despite the occasional sneezing fit and fatty deposit), my little guys are healthy.